Cognitive Overload:

The Coming Surge in Diminished Capacity Cases

And What Wealth Management Firms can do to Protect Their Clients and Themselves.

Chris Heye, PhD1

Elizabeth Loewy, JD2

Katie Wade3

1 CEO and Founder, Whealthcare Solutions Inc.

2 Co-Founder & COO of EverSafe and former Chief of the Elder Abuse Unit, New York County District Attorney’s Office

3 Principal, Dunraven Strategies and former Commissioner, Connecticut Insurance Department

Click here to download a PDF version of the white paper.

1) Demographic shifts are profoundly changing the wealth management industry

a) Demography is destiny

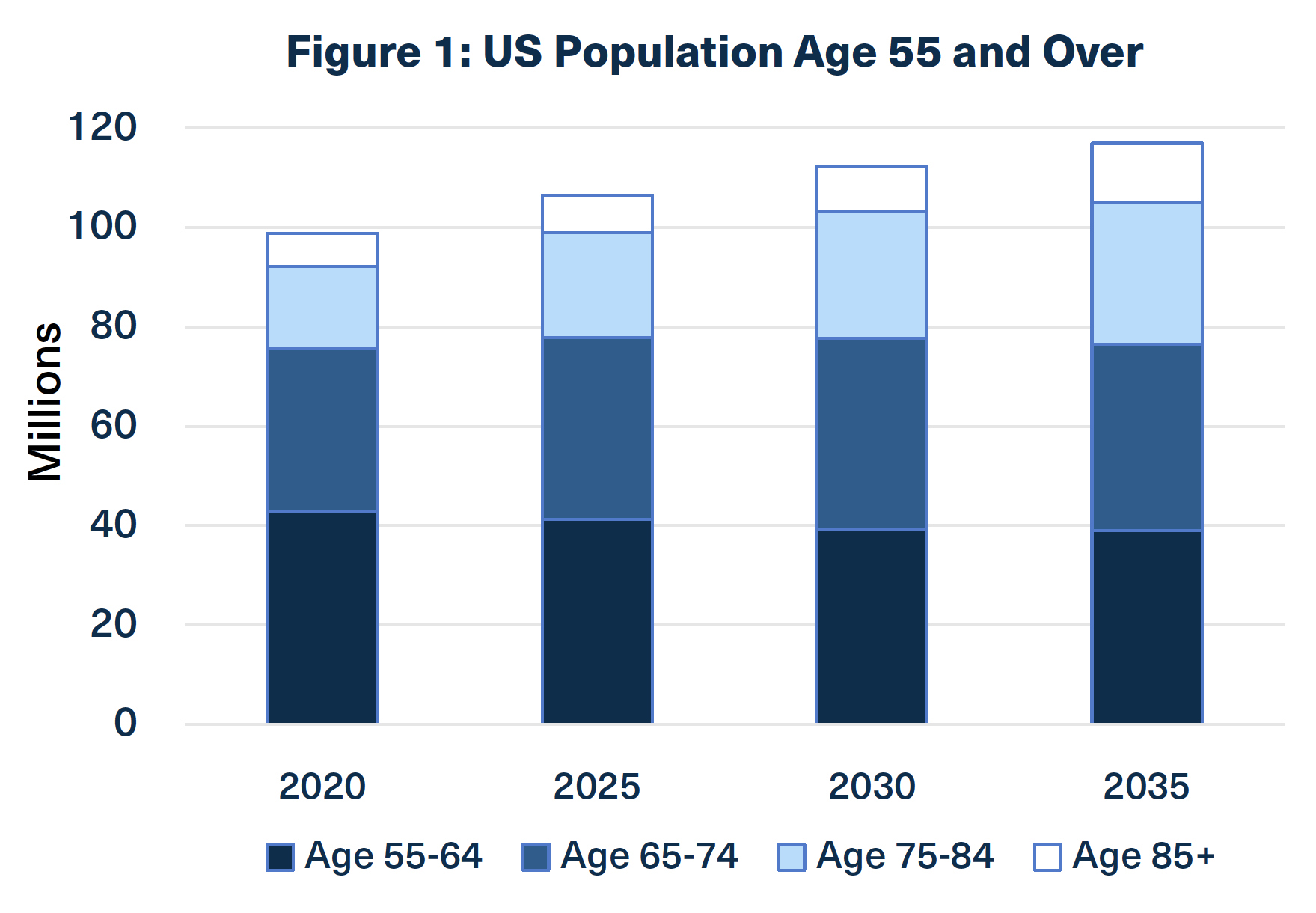

The aging population in the US and other developed nations will fundamentally change the wealth management industry for decades to come. There are currently 98.8 million Americans who are over the age of 54, with more than 56 million of them over 64. By 2030, these totals rise to 112.2 and 73.1 million, respectively. (See Figure 1.) Between now and 2035, the number of people 65 and over is expected to grow more than 6 times faster than the number of those under 55. In 2035, there will be more people in the U.S. over the age of 65 than under 18 for the first time in our history.1

The average age of a financial advisor client in the US is increasing along with the rest of the population. When the stock market bull run started in 2009, the median age of a Baby Boomer was 53. Now it is 65 – and rising. (The average age of a financial advisor client roughly tracks the median age of the Baby Boom generation.2) The product and service requirements (and personal goals) of atypical 53-year-old client are very different than those of most adults over 65. The reasons for the differences extend beyond variations in income earning potential. Nearly 80% of adults in the US over 55 suffer from at least one chronic illness.3 And 47% of adults aged 40-59 are simultaneously raising children and caregiving for aging parents.4 For most clients over 60, it is virtually impossible to separate managing wealth from maintaining health.

b) Aging and a new class of risk

These demographic shifts require advisors to be much more proactive in addressing a new class of risk, namely the financial risks associated with aging. Clients are already well aware of these types of risks. Even before COVID-19, surveys consistently showed that health- and longevity- related concerns dominate adults’ fears around retirement. In Merrill Lynch’s 2017 Retirement survey of older adults, 49% of respondents cited “a costly health issue” as their top financial  retirement worry. (By contrast 13% stated “poor stock market returns”.) In another survey conducted by Franklin Templeton, 47% of respondents cited “health-related costs” as their “top expense concern”.5 Surveys by Fidelity and other wealth management companies demonstrate similar results. Health-related fears always top the list of financial concerns.

retirement worry. (By contrast 13% stated “poor stock market returns”.) In another survey conducted by Franklin Templeton, 47% of respondents cited “health-related costs” as their “top expense concern”.5 Surveys by Fidelity and other wealth management companies demonstrate similar results. Health-related fears always top the list of financial concerns.

Near the top of the list of age-related risks is the threat posed by diminished financial decision-making capacity. A major study concluded that the “peak age” of financial decision-making occurs around age 536, indicating that the majority of advisor clients are already (well) past their decision-making prime. The aging population only makes this situation worse. Unlike the progress we are seeing in other medical fields like cancer and heart disease, success in finding a cure for dementia has been elusive. There have been over 200 failed Alzheimer’s disease trials in the past two decades.7 Alzheimer’s is the only disease among the top 10 causes of death in the US that cannot be prevented, cured, or even slowed. And there is not much hope in sight. “With over 100 years of research and no available disease-modifying therapy, the burden that dementia will cause our society over the next decade is unprecedented”, states Tarun Dua of WHO’s Mental Health and Substance Abuse Department.8

Finally, cognitive decline does not account for the entirety of threats to financial decision-making. Recent studies have identified factors like over-confidence9, depression10, “high-arousal emotions,”11 and impulsivity12 as negatively influencing financial decisions. These types of behavioral disorders – many of which worsen with age – also need to be considered when evaluating a client’s ability to make sound financial decisions. The heightened social isolation forced on most older adults during the pandemic has only exacerbated the risks to optimal financial decision-making.

2) The implications for financial advisory firms

a) Financial decision-making risks and the rise in elder financial abuse

An estimated 10% of adults over the age of 65 are currently living with Alzheimer’s disease.13 An additional 3% suffer from related illnesses, like vascular or frontotemporal dementia. Another 15- 20% of adults over the age of 65 in the US suffer from mild cognitive impairment14. This suggests that upwards of 25% of the average firm’s clients are at risk for poor financial  decision-making and/or exploitation. This estimate does not include other clients with behavioral conditions that place them at risk.

decision-making and/or exploitation. This estimate does not include other clients with behavioral conditions that place them at risk.

Diminished decision-making capacity leaves clients vulnerable to an ever-growing array of scams, financial predators (including the people closest to them), and poor decisions. While inherently difficult to quantify, exploitation of older adults is undoubtedly on the rise. Estimates of the annual costs of senior fraud in the US range from $2.9 to $36.5 billion.15 There were 180,000 cases of financial exploitation reported from 2013 to 2019 according to the Consumer Financial Protection Bureau (CFPB) that involved $6+ billion. By one estimate, approximately 37% of seniors experience financial abuse in any five-year period.16 53% of Americans believe that financial abuse is likely to compromise their ability to live a long, financially secure life. Multiple studies now link elder financial exploitation to poor health outcomes.17 And there is little doubt COVID-19 has made the situation worse18.

The costs of “poor decisions” not associated with financial abuse are similarly not easy to measure. But most of us know older adults who have made unwise choices with their money that they likely would not have made earlier in their lives. Impulse purchases, over-confident bets, and ill-considered investments can all wreak havoc on personal finances.

b) The six risks to the firm

Diminished capacity poses risks not just for individual clients, but for all wealth management firms. There are at least six major risks associated with managing clients with diminished capacity.

i) Loss of the primary account holder’s assets

The inability to successfully identify and manage diminished capacity can result in the loss of some or all of a client’s current assets under management. Financial exploitation and/or impulsive decision-making left unchecked can lead directly to substantial account outflows and/or significant declines in overall portfolio value.

The perceived inability to adequately address diminished capacity issues can further result in declining client satisfaction and loyalty. An estimated 58% of high net worth (HNW) investors have switched financial advisors within their lifetime, with 23% having done so within the past five years19. The recent pandemic and associated market volatility may be accelerating a feeling of restiveness, with 20% of wealth management clients in a recent McKinsey & Co survey indicating that are “likely or somewhat likely to switch financial advisors in the next 12 months”. This figure rises to 40% for clients who do not view their advisor as being “proactive”.20

The perceived inability to adequately address diminished capacity issues can further result in declining client satisfaction and loyalty. An estimated 58% of high net worth (HNW) investors have switched financial advisors within their lifetime, with 23% having done so within the past five years19. The recent pandemic and associated market volatility may be accelerating a feeling of restiveness, with 20% of wealth management clients in a recent McKinsey & Co survey indicating that are “likely or somewhat likely to switch financial advisors in the next 12 months”. This figure rises to 40% for clients who do not view their advisor as being “proactive”.20

ii) Loss of opportunity to consolidate held away assets

Aging is an asset consolidation process, as adults are advised to simplify their financial accounts as they get older. This may present risks to the firm, especially if it controls less than 100% of a client’s total assets. The current rate of “money in motion,” i.e., money that is in transition or that hasn’t found a purpose, yet – is up 350% over the normal rate and twice the rate it was following the financial crisis of 2008-09.21

It is clear that clients of financial advisors are increasingly willing to part ways with a current advisor and move their money to a firm where they feel they are most effectively served. Firms that are not helping their clients more effectively identify and mitigate age-associated financial risks – like those presented by diminished capacity – are in danger of losing them to competitors who are.

iii) Loss of assets inherited by heirs

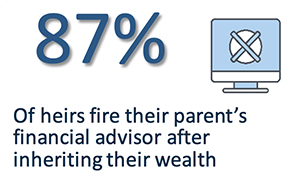

The aging of the Baby Boom generation is largely responsible for the massive transfer of personal wealth that is just getting underway. Cerulli Associates projects that roughly 45 million US households will transfer a total of $68.4 trillion to heirs and charity over the course of the next 25 years.22 But what will the heirs do with their inherited money?

Probably not keep it with their parent’s advisor. An estimated 87% of heirs fire their parent’s financial advisor either to manage the money themselves, or move it to a rival investment firm.23 This unprecedented transfer of wealth presents another major opportunity, and risk, for the firm. Diminished capacity is invariably a highly sensitive subject within families. If an advisor has a good relationship with his client’s children, and if they can demonstrate that they did everything they could to protect the parent(s) from health-related risks like diminished capacity, the advisor will have a better chance of holding on to the assets of a deceased client.

Probably not keep it with their parent’s advisor. An estimated 87% of heirs fire their parent’s financial advisor either to manage the money themselves, or move it to a rival investment firm.23 This unprecedented transfer of wealth presents another major opportunity, and risk, for the firm. Diminished capacity is invariably a highly sensitive subject within families. If an advisor has a good relationship with his client’s children, and if they can demonstrate that they did everything they could to protect the parent(s) from health-related risks like diminished capacity, the advisor will have a better chance of holding on to the assets of a deceased client.

iv) Cost of building a service model to manage the at-risk clients

To be properly shielded from age-related risks like diminished capacity, clients will need to receive more proactive notifications and more targeted educational content concerning the growing proliferation of financial products and services and their benefits. Clients will also require support for the service or product journeys that firms will establish to guide them to execution. These highly personalized client journeys will require a new technology infrastructure that is more reliable and scalable than what a human advisor can do manually.

These technology upgrades and business re-organizations will take time and cost money. But failure to make necessary adjustments will increase a firm’s risk of losing some or all of their managed assets.

v) Exposure to regulatory risks

Diminished capacity cases expose firms to mounting regulatory risks. There are increasing sanctions for misconduct. During the last five years, FINRA has implemented a number of rules focused on senior investors. Rule 2165 permits brokers to place a temporary hold on a disbursement of funds or securities from ‘specified adults’ when financial exploitation is suspected. These adults include those who appear to have a mental impairment that renders them unable to protect their interests. Firms must now also attempt to collect “trusted contact” information under Rule 4512, and FINRA recently revised its guidance to explicitly include the age and vulnerability of victims as factors in setting sanctions for misconduct.24

States too have their own reporting rules. While each of the states’ regulatory rules relating to reporting is unique, most address exploitation of victims who have reached a certain age or who are vulnerable for reasons relating to diminished mental capacity, or both.

In short, regulators are focusing more attention on advisors’ interactions with older adults and the steps they are taking to protect seniors. Most industry observers expect regulatory scrutiny and the size of the financial penalties for non-compliance both to increase in the years ahead as the population ages.

vi) Exposure to reputational risks

Cases involving diminished capacity are typically messy and often emotional. As a result, any publicity accompanying diminished capacity issues poses additional reputational risks. One of the more well-known cases involving elder financial abuse is the one involving New York City philanthropist, Brooke Astor. Mrs. Astor was the victim of Grand Larceny and other crimes at the hand of her only son, Anthony Marshall. Despite being appointed his mother’s power of attorney, health care proxy, and executor, Marshall and his attorney, Francis Morrissey, defrauded Astor of millions a few years after her diagnosis of Alzheimer’s disease. Their scheme included taking advantage of her diminished capacity by inducing her to sign estate documents she clearly did not understand, according to witnesses. One such document, a codicil, redirected a $60 million residuary from charity – to Marshall. Mrs. Astor passed away before the trial. Both Marshall and Morrissey were convicted and sentenced to state prison.

3) Regulation and principles for consideration

a) Current regulations

The following are the most relevant regulations that govern advisors’ activities with respect to older adult clients:

-

-

- FINRA rule 4512 – requires that broker dealers attempt to collect the “name of and contact information for a trusted contact person age 18 or older who may be contacted about the customer’s account”.

- FINRA Rule 2165 – known as the “Report and Hold” rule, permits a member that reasonably believes that financial exploitation has occurred, is occurring, has been attempted, or will be attempted to place a temporary hold on the disbursement of funds or securities from the account of a “specified adult” customer. A member relying on this Rule must also develop and document training policies or programs reasonably designed to ensure that associated persons comply with the requirements of this Rule.

- The Senior Safe Act – provides immunity from liability in certain civil or administrative proceedings for reporting potential exploitation of a senior citizen. The Act requires that certain employees receive training on how to identify and report exploitative activity against seniors before making a report.

- State by state standards – twenty-nine states now require investment advisors and/or broker dealers to report suspected exploitation of an older or vulnerable client. The states vary as to what agency should be receiving these reports, but in most states, they include Adult Protective Services (APS), State Securities regulators, and/or law enforcement. For more on state regulatory requirements related to senior protection, visit https://www.eversafe.com/mandatory-reporting/.

-

b) FINRA/Stanford Center for Longevity 2019 Study

In 2017 and 2018, the FINRA Investor Education Foundation, in collaboration with the Stanford Center on Longevity, conducted a study to expose the process of fraud victimization and understand the factors associated with losing money (https://www.finrafoundation.org/files/exposed-scams-what-separates-victims-non-victims). The study involved interviewing and surveying targets and victims of financial fraud who had reported their experiences to BBB Scam Tracker, an online fraud reporting tool of the Better Business Bureau. Based on their analysis of the survey and interview data, the report authors offered several recommendations. These suggestions are ultimately for the client, though advisors should be aware of their implications and make efforts to help their clients better understand the scope and nature of financial scams.

-

-

- The manner in which people are contacted plays a significant role in whether or not they become victims. Individuals contacted digitally appear to have higher engagement and victimization rates, indicating that clients should be particularly careful when sending money based on a digital message or ad.

- The perception that a fraudster is “official” is highly associated with victimization. Individuals should therefore seek to independently verify the identity of anyone who claims to be an authority and asks for money or information (e.g., call the agency directly to confirm, or use an online tool such as FINRA BrokerCheck).

- Financial insecurity appears to increase the likelihood of victimization, as do low levels of financial literacy. On the other hand, prior knowledge about fraud, even generally, is particularly helpful in avoiding victimization. Improving client financial literacy should be an important goal for all advisors.

- Getting help from disinterested third parties makes a difference. The study results indicated that people who got outside advice were less likely to lose money. Before complying with any suspicious solicitation, clients should consult with those around them, including their financial advisor where appropriate, to verify the legitimacy of the offer or the threat.

-

c) 2020 Report to the US Secretary of Labor

The Advisory Council on Employee Welfare and Pension Benefit Plans recently (December 2020) released a report to the United States Secretary of Labor entitled “Considerations for Recognizing and Addressing Participants With Diminished Capacity” (https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/about-us/erisa-advisory-council/2020-considerations-for-recognizing-and-addressing-participants-with-diminished-capacity.pdf). This report includes recommendations from various government agencies (Consumer Financial Protection Bureau (CFPB), FINRA, Employee Benefits Security Administration), industry groups (SIFMA, American Benefits Council), financial services companies (Fidelity, Voya, AIG), and academics (Stanford). The recommendations apply to employers, fiduciaries, retirement and benefit plan sponsors, and plan service providers.

In this report, the CFPB lays out the most comprehensive set of recommendations for protecting older adults from financial exploitation, including:

- Providing mandatory training for the staff of employers, plan sponsors, and service providers on both diminished capacity and financial exploitation.

- Offering protective opt-in account features including the ability to set alerts for specified account activity and provide read-only access for authorized third parties.

- Implementing procedures to ensure that decisions on whether to accept a Power of Attorney are made promptly and are only based on appropriate legal considerations.

- Developing new ways to provide services, training and communication to clients in a socially-distant virtual world.

- Making online and mobile platforms more accessible.

Other recommendations offered in the report include:

- Providing information on diminished capacity through employee financial wellness programs.

- Including long-term care related options in planning systems and software.

- Finding and utilizing local support groups, mental and behavioral health specialists, and community and public sector activities and support services

- Employing technology to identify changes in behavior like a change in the risk profile

d) 2016 NASAA Guidance

In 2016, the North American Securities Administrators Association (NASAA) issued “A Guide For Developing Practices And Procedures For Protecting Senior Investors And Vulnerable Adults From Financial Exploitation”. The Guide offers a comprehensive set of recommendation focused primarily on issues of training, client communication, internal reporting, and identification and assessment of capacity. Specifically, the report recommends that financial services firms:

-

-

- Develop training programs, policies, and procedures designed to detect potential financial exploitation. An integral component of a firm’s policies and procedures should be training to spot the signs of cognitive decline or a reduced capacity to handle financial decisions.

- Consider providing client-facing and other personnel, such as supervisors and compliance staff, an assessment tool for cognitive skills that can be incorporated into ongoing training on how to communicate with clients.

- Increase the frequency and quality of communication with their clients, including developing communication tools that emphasize the importance of future planning. These tools should facilitate discussions to guide the customer toward establishing advance financial directives and making preparations for medical emergencies.

- Mandate the use of internal reporting forms to ensure that each report contains critical information including the name of the client, the relevant dates, a description of the events that led to the report, a description of the steps the firm has taken or expects to take in response, and any relevant additional documentation.

-

4) A framework for managing diminished capacity risk

a) Robust system to secure and update trusted contact information

Having up-to-date information on the names and roles of trusted contacts is very important. These contacts do not have to be family members, and it is a good idea to designate more than one. Unfortunately, studies have found that many elder fraud cases are perpetrated by adult children of the senior. For this reason, considering the designation of two children or a professional and an adult child may be advisable.

b) Training for both advisors and LRC professionals

Firms should consider providing their advisors, as well as legal/risk/compliance (LRC) professionals, with comprehensive training on how to more effectively identify and manage clients with diminished capacity. FINRA Rule 2165 already requires advisor training to ensure that advisor comply with the regulation, though FINRA does not provide details on the nature and scope of the training.

Ideally, training programs will be informed by experienced professionals who specialize in working with older adults. Firms should consider input from psychiatrists, geriatricians, neurologists, elder law attorneys, prosecutors, geriatric care managers, and other experts who work in the elder care space. Findings from academic research studies by non-practitioners can be important as part of an overall framing of the issues, but there is no substitute for insights and recommendations from professionals with direct experience caring for older adults and their families on a daily basis. Educational materials designed for clients should also consider including contributions from these specialists.

Recommended training program areas include the following:

-

-

- How to successfully initiate and sustain client conversations on “sensitive” topics like health, longevity, and diminished capacity. Effective and frequent client communication is essential to protecting your client, and your firm, from the risk posed by diminished capacity,

- How to identify signs of diminished decision-making capacity. In addition to receiving instruction in identifying the most common indicators of cognitive decline, firms are advised to educate their employees about the behavioral risks often associated with getting older, like over-confidence, loneliness/social isolation, and impulsivity. The behavioral changes that occur later in life can be as (or more) consequential for financial decision-making as the typically cited biases in the behavioral finance literature.

- How to more effectively protect clients from financial exploitation. This might include instruction in a) implementing client transaction firewalls, e.g., alerts for specified account activities that include notifications to trusted contacts, b) utilizing read-only fraud monitoring technologies, c) reviewing the scope and nature of the legal documents that protect clients, e.g., power of attorney, will, trust, and d) recognizing the most common forms of financial exploitation, including abuse by a family member or caretaker.

- How to get help from other professionals. Psychiatrist and New York Times best-selling author Dr Edward Hallowell advises to “never worry alone”. This training session might include assistance in finding the appropriate professionals and organizations in your area that your firm can go to for more help (e.g., psychiatrists, Alzheimer’s support groups, elder law attorneys, etc.).

- How to create protocols designed to handle suspected elder financial abuse, including the red flags of exploitation and how to escalate cases within the firm. Training might also include instruction in how to identify and work with local resources like adult protection services (APS) and US Department of Justice’s Elder Justice Initiative multidisciplinary teams (MDT).

-

c) A simple assessment that objectively evaluates the client’s ability to make sound financial decisions

Diminished financial decision-making capacity can be difficult to detect, even for experienced medical professionals. The two most common cognitive tests25 26 are designed to measure capabilities like short-term memory, language fluency, orientation, and motor skills. But, as previously noted, studies have identified other behavioral factors like over-confidence, depression, and impulsivity as harmful for financial decision-making. Unfortunately, this means that even if your client successfully passes a standard cognitive test, they still may be at risk for poor financial decision-making or exploitation. Think of the lonely widow/er, despondent divorcee, or impulsive gambler.

Conventional risk tolerance questionnaires are also not helpful in identifying diminished capacity. In fact, they could generate recommendations that are potentially harmful to the client. One side-effect of dementia is lack of “inhibitory control”, a condition that can lead to excessive risk taking.27 A related condition is the decline in executive function that makes it harder for a person to “connect the dots”.28 This suggests that a client might answer a risk tolerance questionnaire in a way that indicates they are “risk loving” when what the client is really demonstrating is an inability to comprehend the longer-term consequences of their decisions.

Whealthcare Planning (www.whealthcareplan.com) offers an online screening tool based on a clinical study conducted at Massachusetts General Hospital (MGH) that is designed to help identify traits that could make a client vulnerable to poor financial decision-making and/or exploitation. The study was led by Dr Anthony Weiner, Director of Outpatient Geriatric Psychiatry at MGH, and a summary of the results of the study has been published in the journal Alzheimer’s & Dementia.29

The assessment is fully digital and can be administered remotely. An advisor, or other financial services professional (e.g., member of the legal/risk/compliance staff) does not require any specialized training to administer the assessment. It takes a client only about 12-15 minutes to complete, and the results are available to the adviser immediately. The summary report provides scoring for behavioral, cognitive, and financial literacy components of decision-making capacity – and offers suggestions for next best actions to take with the client. A history of the scores for each client is maintained, establishing a benchmark and ensuring that changes overtime in scores can be measured and tracked. The results can be sent directly to the client and/or to a pre-approved advisor or a family member.

The assessment is appropriate for client, spouse, or other any other family member. It does not require the client to collect any personal health or financial information about the client. The assessment has been field-tested for 3 years by advisors working mostly for small to medium-sized RIAs, with more than 1,200 assessments administered during that time.

d) A proactive warning system that helps protect clients from fraudsters

In 2019, FINRA reviewed firms’ practices, including protocols, escalation policies, and training initiatives related to senior investor issues. In evaluating how brokers identified and responded to risks related to vulnerable clients and their caregivers, FINRA supports the use of software tools, making specific mention of those that:

- Highlight potential instances where a senior investor is at risk for poor financial decision-making or exploitation, and facilitate collaboration on financial decisions with trusted individuals; and

- Monitor alerts relating to any concerning or inconsistent financial activity, contact trusted individuals and assist with remediation efforts.

One advantage of using software applications for fraud monitoring is its ability to analyze activity across financial accounts and institutions. Banks and firms share their clients’ financial information only in limited situations. For this reason, they lack visibility, even if they decide to take an active role in monitoring. Scammers rarely steal from seniors by withdrawing one large amount from one account at one institution in one transaction. They routinely initiate their scheme with a small ‘test’ transaction, followed by activity affecting a number of accounts, including checking, savings, investment, retirement, and credit cards. Moreover, financial institutions are limited in their capacity to notify a client’s family members or other trusted contacts because of privacy regulations.

A proactive early warning system should therefore strive to include the following features:

- The ability to effectively identify irregular financial activity, as an individual’s habits will frequently change with the onset of diminished capacity.

- The capacity to monitor across bank, investment, and other financial accounts, including non-credit accounts. (Fraudsters do not routinely target credit-based accounts.)

- The ability to notify the client, as well as the client’s trusted contacts, of any suspicious activity. Some or all of the trusted contacts should be given “read-only” access to the monitoring results without having direct access to the accounts themselves. This is less risky than establishing a joint account and reduces the possibility of fraud perpetrated by family members.

EverSafe (www.eversafe.com), for example, evaluates a client’s historical financial behavior to establish a personal profile, and then analyzes daily transactions to identify erratic activity. Its “trusted advocate” feature enables individuals to designate family members and/or other trusted individuals, including their financial advisor, to receive alerts and assist in monitoring.

e) A methodology for engaging clients and their families about other topics of longevity

Cognitive and behavioral changes in older adults can occur rapidly. It is therefore critical that advisors stay in close communication with their clients and families, especially when there are known medical issues. “The goal” says Dr Anthony Weiner at MGH, “is to create an alliance” between you and the client. “Demonstrate that you are on their side, and that you always have their best interests in mind”. Surveys indicate that poor communication is the number one reason clients leave their financial advisor.30 So better engagements around diminished capacity are a win-win, protecting the client while safeguarding the business.

It is critical to emphasize the importance of preparation. If you are having trouble initiating client discussions around diminished capacity, we suggest you start by acknowledging the difficult nature of the conversation and emphasize the risks of NOT taking preventative measures. Impress upon the client that it is your job to protect them from all threats, not just market fluctuations.

5) Conclusion

Absent a major breakthrough in the treatment of Alzheimer’s and other forms of dementia, the prevalence of diminished capacity in financial wealth management clients will increase as the population ages. Based on the available statistics on the frequency of Alzheimer’s, other forms of dementia, and mild cognitive impairment, upwards of 25% or more of an average firm’s clients are already at risk. This suggests that 25% or more of the average firm’s total assets under management are similarly at risk. And this percentage will continue to rise as long as the average age of the client population increases.

We recommend that firms view diminished capacity the same way they would perceive any other risk that threatens 25% or more of their business. Time and money spent protecting clients and preparing them for the day they can no longer safely manage finances on their own is likely to be a valuable investment over time. It is clear win-win result for both your firm and your client.

Footnotes

1 US Bureau of the Census

2 Simon-Kucher & Partners

3 Centers for Disease Control and prevention, National Center for Health Statistics https://www.cdc.gov/nchs/health_policy/adult_chronic_conditions.htm

4 Pew Research Center, 2013. “The Sandwich Generation.”

5 Franklin Templeton 2019 Retirement Income Strategies and Expectations (RISE) Survey

6 Agarwal S, Driscoll JC, Gabaix X, Laibson D: The age of reason. Financial decisions over the life-cycle with implications for regulation. Brookings Papers on Economic Activity 2009; Fall: 51-101

7 Siva, N,: New global initiative to tackle Alzheimer’s disease. The Lancet, Volume 397, Issue 10274, 13–19 February 2021, Pages 568-569

8 Ibid.

9 Gamble K, Boyle P, Yu L, Bennett D: Aging and Financial Decision Making, Management Science 2015 Nov;61(11):2603-2610

10 Lichtenberg, P. A., Stickney, L., & Paulson, D. (2013). Is Psychological Vulnerability Related to the Experience of Fraud in Older Adults? Clinical Gerontologist,36(2), 132-146.

11 Heightened Emotional States Increase Susceptibility To Fraud In Older Adults, 2016, by Katharina Kircanski, Stanford University, Nanna Notthoff, Stanford University, Doug Shadel, AARP Washington, Gary Mottola, FINRA Investor Education Foundation, Laura L. Carstensen, Stanford University, Ian H. Gotlib, Stanford University

12 Weiner, AP, Heye, C, et alia.: Cognitive Function As A Proxy Of Financial Decision Making In Older Primary Care Adults, July 2017, Alzheimer’s and Dementia 13(7):P1558-P1560

13 2018 Alzheimer’s Association Facts & Figures

14 Ibid

15 Consumer Reports. Available at: http://www.consumerreports.org/cro/consumer-protection/financial-elder-abuse-costs–3-billion—–or-is-it–30-billion- Accessed September 25, 2015.

16 True Link Financial Report on Elder Financial Abuse 2015. Available at: https://truelink-wordpress-assets.s3.amazonaws.com/wp-content/uploads/True-Link-Report-On-Elder-Financial-Abuse-012815.pdf Accessed February 1, 2015.

17 See for example Burnett J, Jackson SL, Sinha AK, Aschenbrenner AR, Murphy KP, Xia R, Diamond PM.: Five-year all-cause mortality rates across five categories of substantiated elder abuse occurring in the community, J Elder Abuse Negl. 2016;28(2):59-75

18 See for example https://www.cnbc.com/2020/09/22/americans-have-lost-145-million-to-fraud-linked-to-covid-19.html

19 The Spectrum Group

20 “North American Wealth Management”, December 2020, McKinsey & Co

21 “North American wealth management”, December 2020, McKinsey & Co

22 “U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2018: Shifting Demographics of Private Wealth”, Cerulli Associates

23 The Cerulli Edge, U.S. Retail Investor Edition, Q2 2019

24 FINRA Sanction Guidelines, October 2020 https://www.finra.org/rules-guidance/oversight-enforcement/sanction-guidelines

25 https://www.mocatest.org/

26 NIH https://www.ncbi.nlm.nih.gov/projects/gap/cgi-bin/GetPdf.cgi?id=phd001525.1

27 Wikipedia https://en.wikipedia.org/wiki/Inhibitory_control#:~:text=Inhibitory%20control%2C%20also%20known%20as,to%20select%20a%20more%20appropriate

28 WebMD https://www.webmd.com/add-adhd/executive-function

29 Weiner, AP, Heye, C, et alia.

30 See for example Natixis Investment Managers https://www.im.natixis.com/us/press-release/natixis-survey-finds-financial-professionals-expect-strong-industry-growth

© Copyright EverSafe 2021