It’s Your Money... Let’s Keep It That Way.

All-in-one protection from scams, cyber threats, and identity theft. Maintain financial independence and peace of mind.

It’s Your Money... Let’s Keep It That Way.

All-in-one protection from scams, cyber threats, and identity theft. Maintain financial independence and peace of mind.

As featured on

Are You and Your Loved Ones at Risk?

It’s likely you already know someone who has been scammed.

Your odds of falling victim to online crime are 1 in 4… even if you never go online.

On average, seniors lose $120,300 to financial exploitation.

Caregivers bear emotional and financial damage when they witness loved ones lose their life savings.

Protect Yourself

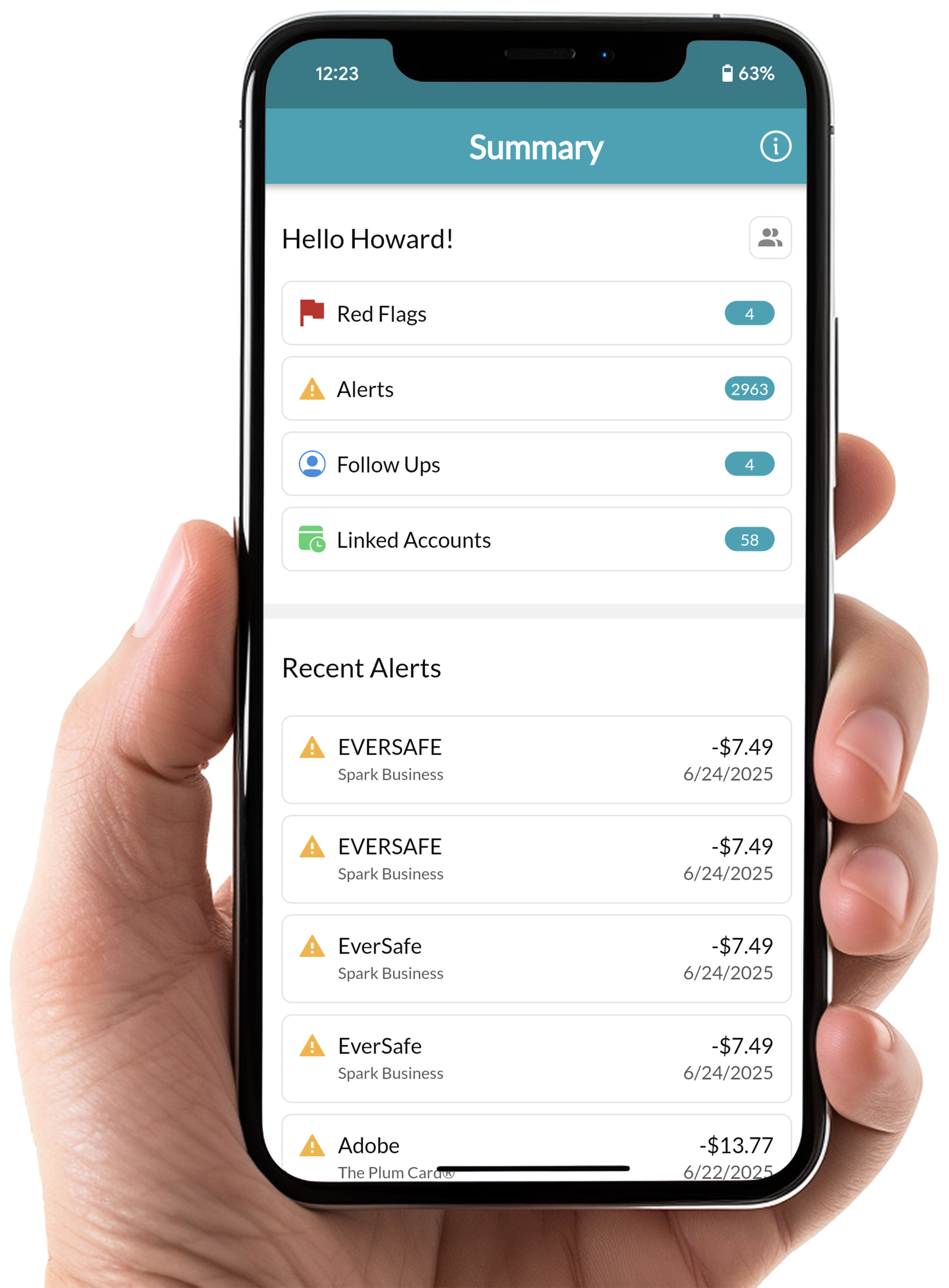

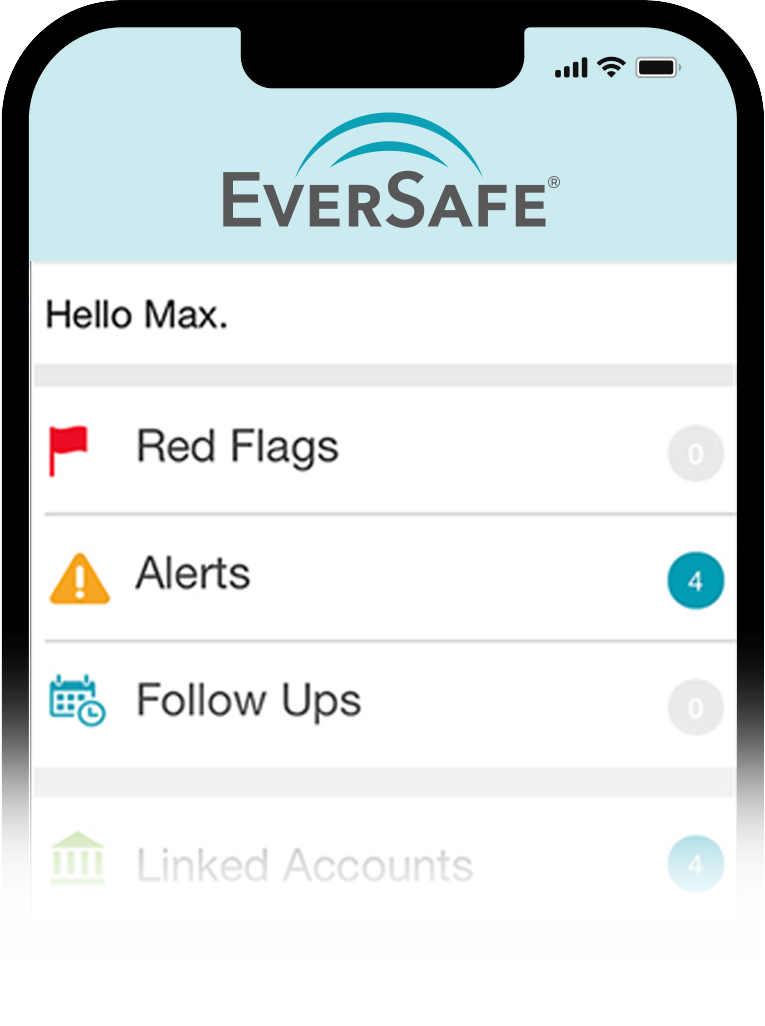

Staying on top of your finances is challenging. EverSafe alerts you to suspicious activity. Our consolidated dashboard simplifies monitoring across accounts and institutions.

Protect Others

Whether you’re the adult child of an aging parent, a caregiver, or a professional serving older clients, EverSafe is here to help.

Personalized Monitoring

EverSafe detects suspicious activity across banking, investment, and credit card accounts, as well as all 3 major credit bureaus.

AI-Powered Scam Detection

EverSafe’s CATCH monitoring identifies phishing and other scam emails before money is lost.

“Smart” Alerts for You, Your Family & Professionals

Designate those you trust to serve as an “extra set of eyes” to help safeguard your money and your personal information.

Easy to Use

Simple to set up – no tech expertise required.

Your family’s financial safety starts here. Protect their future today.

Always Safe & Secure

Historical Lookback

Our exclusive 6-month lookback at your credit and financial activity often detects suspicious activity on Day One. Machine learning applied to historical transactions informs each member’s personal financial profile for future analysis of suspicious activity. Previous breaches and personal information for sale on the Dark Web are identified for remediation.

Customer Friendly

We built EverSafe to keep you and your loved ones

safe and secure, but we also have the most customer friendly policies in the industry. We provide a free trial – try before you buy. Our service comes with a lifetime price guarantee. You can cancel at any time with a full

refund for unused services and we include $1M in coverage against identity theft if it occurs while an EverSafe member.

24/7 Support

We provide around-the-clock support because problems can’t always wait until morning. Our support staff are US based and experts in fraud remediation and identity restoration. As a member, you will receive a monthly Scam Watch Notice and a Financial Health Newsletter. If you receive a suspicious email, text, or voicemail, simply forward it to us for a professional evaluation.