How We Do It

Protecting Your Financial Independence

EverSafe gets in front of scammers by analyzing your finances, credit, real estate, and email. We’ll alert you and your trusted team to suspicious activity and provide expert guidance if there are issues.

Our Four-Step Protection Process

1. Analyze

We Learn Your Financial Patterns

Our technology examines your historical financial behavior to establish a comprehensive personal profile. We understand your unique spending habits, income patterns, and financial routines across all your accounts and institutions.

What We Analyze:

- Historical transaction patterns and seasonal variations

- Regular income and expense cycles

- Investment behavior and bill payment schedules

- Geographic spending patterns

2. Identify

We Spot What Doesn't Belong

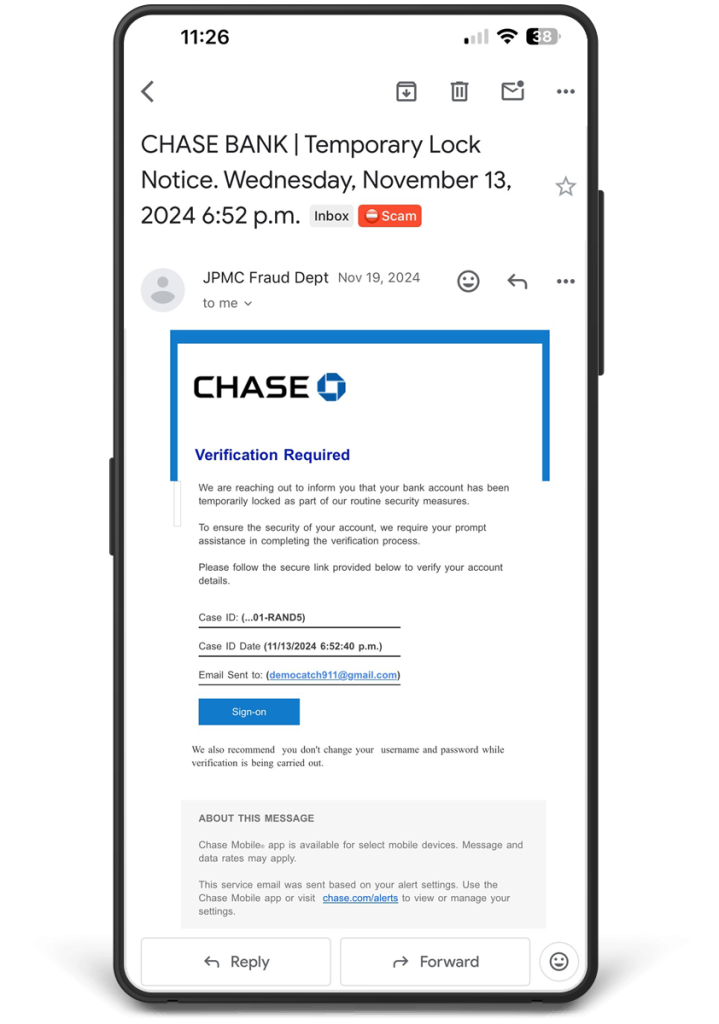

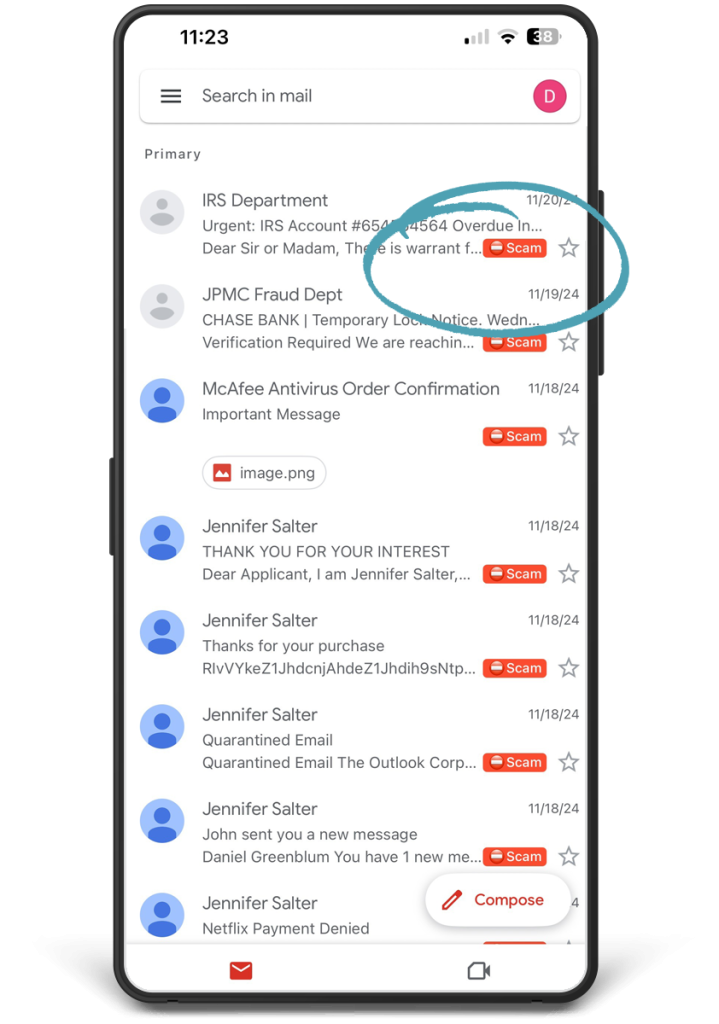

We look for anomalies like unusual withdrawals, missing deposits, irregular investment activity, changes in spending patterns, late bill payments, and more. Using advanced analytics, we continuously monitor for anomalies that could indicate fraud, scams, or identity theft. We look for the subtle signs that others miss.

What We Identify:

- Unusual withdrawals or transfers

- Missing regular deposits

- Irregular investment activity

- Changes in spending patterns

- Late bill payments

- New account openings

- Suspicious charges

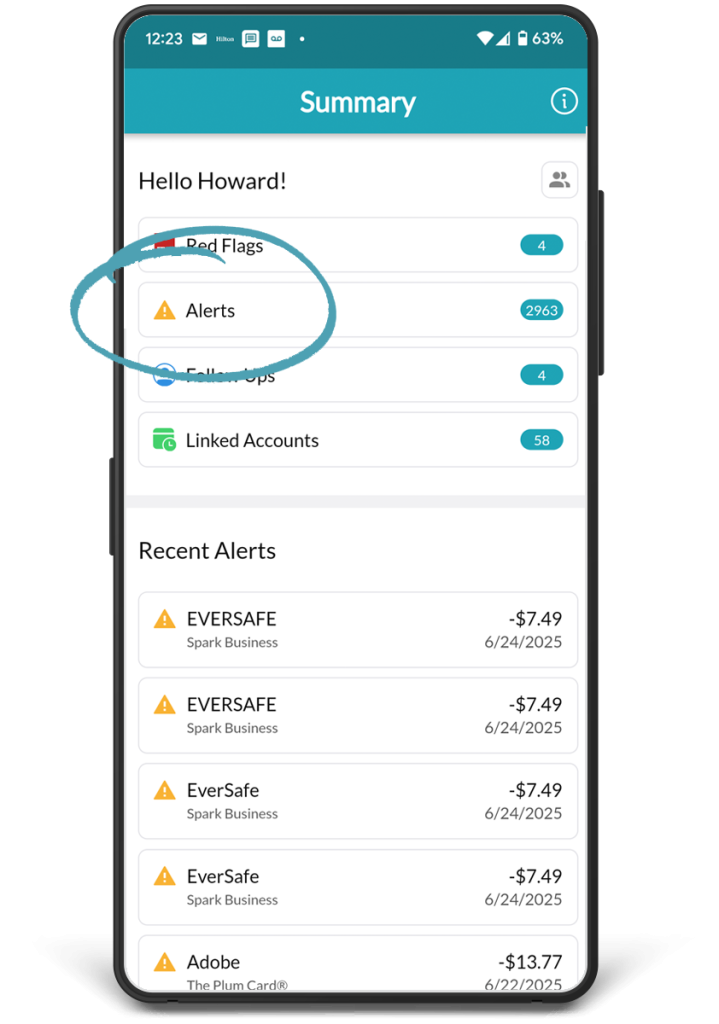

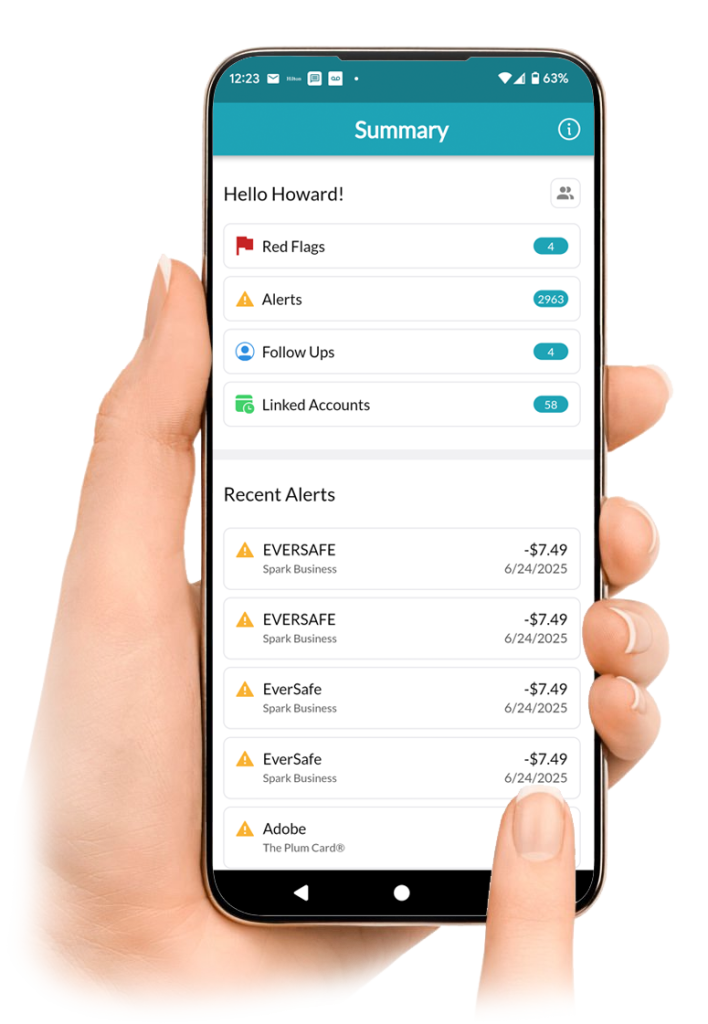

3. Alert

We Notify the Right People at the Right Time

Suspicious activity alerts are delivered by email, text, phone or the EverSafe App. And EverSafe’s “trusted advocate” feature enables members to designate family, professionals or other trusted individuals to receive alerts and assist in monitoring.

How We Alert

- Delivered via email, text, phone, or app

- Priority-based alert system

- “Trusted Advocate” notifications

- Clear, actionable guidance

4. Resolve

We Help You Take Action

EverSafe provides tools and expert support to manage the resolution process and helps you create your recovery plan. We’re always just a phone call away.

How We Help

- 24/7 Support

- Step-by-step resolution guidance

- Expert fraud remediation support

- Identity restoration

Once You Enroll, We Get to Work

- Identifying your personal information historically available for purchase on the Dark Web.

- Analyzing the previous 6 months of your credit file for anomalies.

- Using our exclusive AI-engine to learn your financial history and patterns to establish your personal profile for future analytics behavioral patterns.

- Providing a single/tri-bureau credit report, based on your selected plan.

And It Doesn’t End There

- As an EverSafe member, you can be confident that we’re always at work analyzing financial activity across accounts and institutions.

- Scanning credit files, real estate records, and emails.

- Identifying changes in behavior and unauthorized activity.

- Alerting you and your team of “Trusted Advocates,” if they are designated.

- Helping you stay on top of your finances with all account balances and transactions in one, easy to find place.

- Providing around-the-clock remediation and identity restoration support.

Getting Started is Easy

Enroll yourself or someone else

Connect your financial accounts and enable credit monitoring

Designate your “Trusted Advocates” to serve as an “Extra Set of Eyes”

Add real estate and email scanning, for more holistic protection, and you’re good to go!

What Makes Us Different

Comprehensive Cross-Institution Monitoring

Unlike bank-specific alerts, EverSafe monitors across ALL your financial institutions because that’s how scammers operate. We see the complete picture of your financial life.

Age-Specific Protection

Our algorithms are specifically designed for seniors, understanding age-related financial patterns and providing protection tailored to your life stage.

Family-Centered Approach

We understand that financial security often involves family. Our trusted advocate system enables collaborative protection while maintaining your independence.

Expert Human Support

Technology alone isn’t enough. Our team includes former law enforcement professionals and fraud experts who provide real human support when you need it most.