What We Do

Advanced Protection That Thinks Like You Do

Discover how our comprehensive features work together to safeguard your independence while giving your family peace of mind.

Core Protection Features

Smart Financial Monitoring

Prepare for the Unexpected with “Smart” Alerts

What We Monitor

- Banking, investment, credit card, trust, and retirement accounts

- Opening of unauthorized accounts – at your bank and elsewhere

- All 3 major credit bureaus

- Real estate titles and liens

- Dark Web

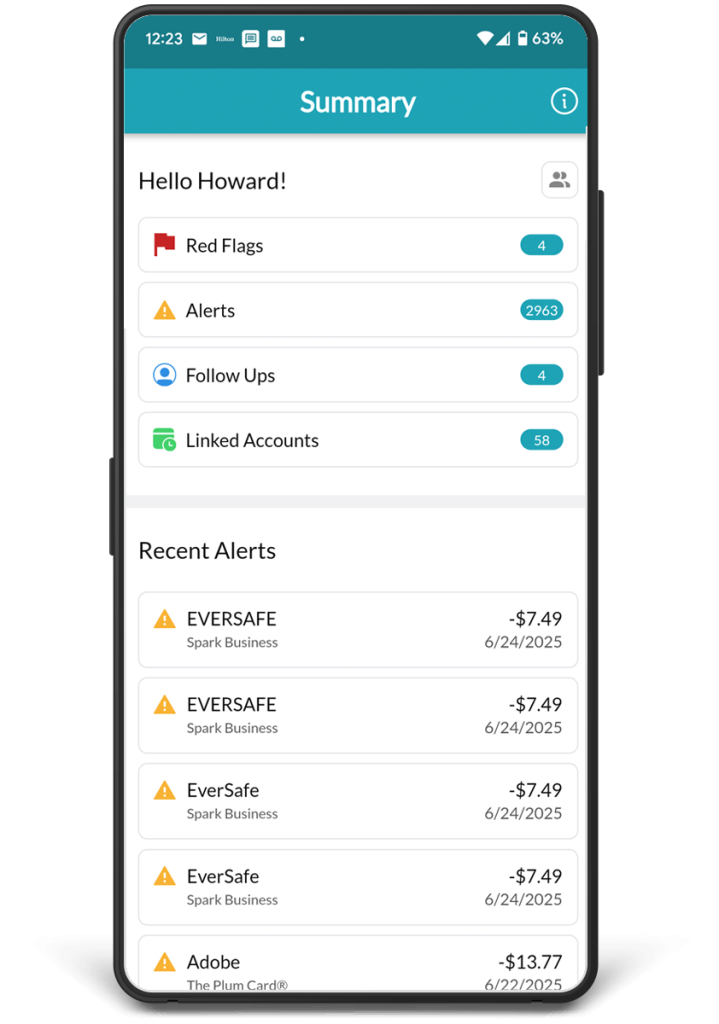

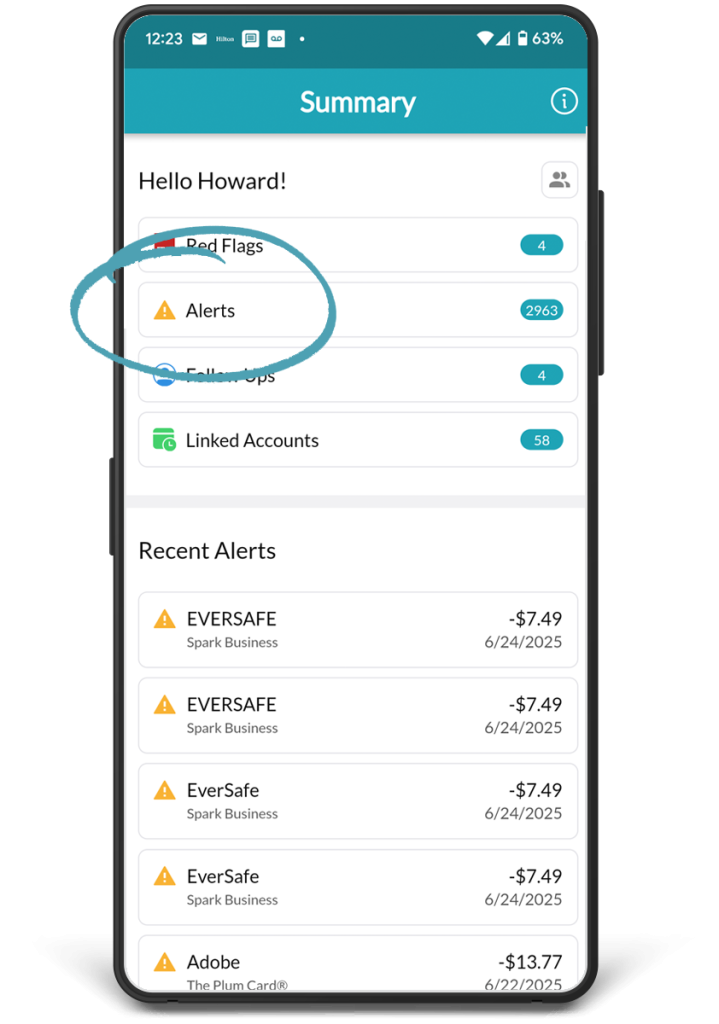

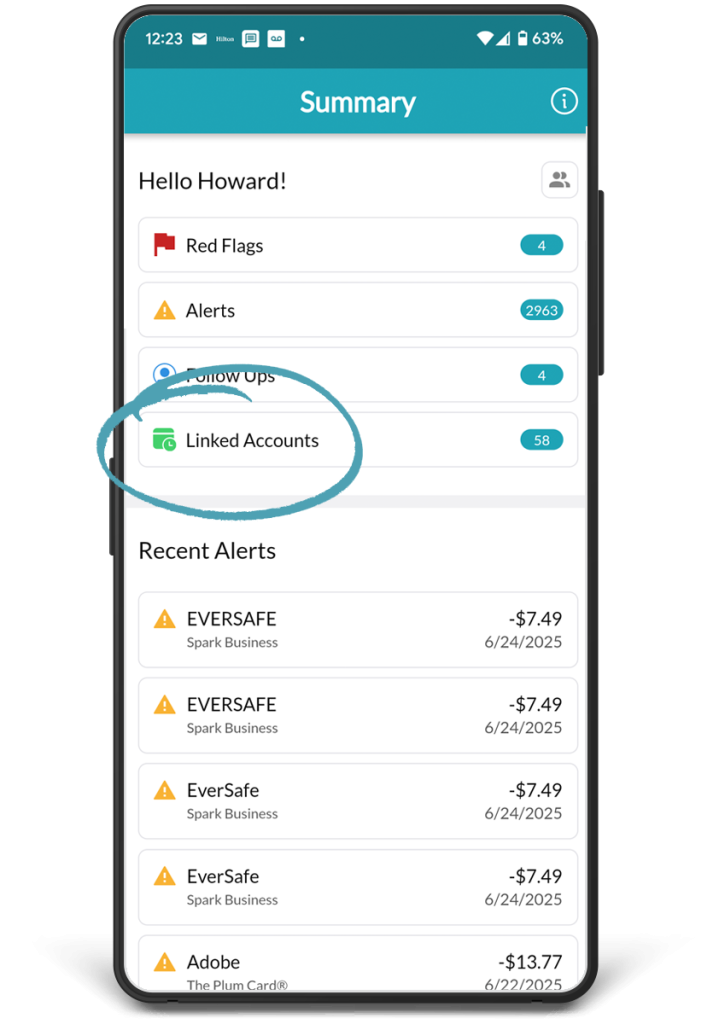

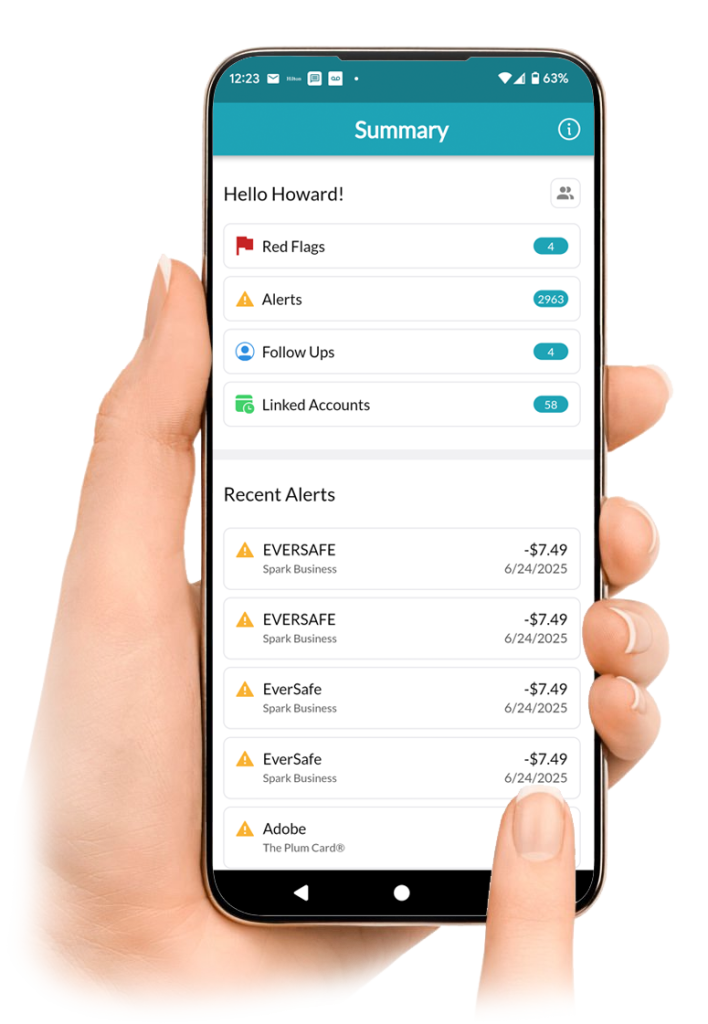

All Your Accounts, In One Place

Helping You Stay on Top of Your Finances

Easy-to-View Dashboard Includes

EverSafe’s monitoring is the first step to a good night’s sleep. Connect all your bank accounts, credit cards, loans, real estate, investments, and credit reports to see your entire financial picture in one place. EverSafe brings all your transactions into one clean, searchable list – no more jumping between apps or bank websites. And our exclusive “trusted advocate” feature means that you don’t have to watch out for trouble – alone.

- Your consolidated view of balances and transactions across accounts and institutions

- Notifications we detect including interest rate increases, credit limit changes, and years-old recurring/subscription charges

- Property value and real estate taxes

- Share alerts and notifications with designated trusted others

CATCH Real-Time Email Monitoring

Stop Financial Fraud, at its Source

Proactive Email Surveillance

- Incoming emails are scanned and flagged within moments

- Far less guesswork – your emails are labeled in the email app as Low Risk, Caution, or Scam

- Our technology adapts to email habits for “smarter” protection over time

- Designated trusted others can receive alerts along with you

“Trusted Advocates”

Can Provide Helpful Oversight In Monitoring

Effective monitoring sometimes involves a team. You can designate one or more trusted family members, caregivers, and/or professionals to serve as an “extra set of eyes” who receive alerts along with you. Our exclusive “Trusted Advocate” feature means you can work, play, or travel knowing that you’re not alone in keeping an eye on your money and your personal information.

Designate Trusted Others

- You chose who and how many “trusted advocates” – it’s no extra cost

- You control what and how much they see

- Maintain your financial independence with added protection for your finances and identity

- Exclusive support for Powers of Attorney and Guardians/Conservators

24/7 Expert Support

For Problems That Can’t Wait Until Morning

Our team includes fraud prevention experts, including a former NYC prosecuting attorney who specialized in financial crime. We’re available around-the-clock to help address issues and guide you through resolution. Your peace of mind is our priority.

Remediation and Resources

- US-based fraud prevention and resolution expertise

- Backed by 30 years of investigative experience in in civil and criminal matters

- 40 years of corporate history in financial technology

We Walk the Walk

- Real-time scam prevention from the first point of contact

- Comprehensive cross-institution monitoring and best-in-class connectivity to 99% of the financial institutions across the US

- Protection for seniors: our co-founder has experience handling thousands of cases involving older victims of fraud and theft

- Family-centered approach