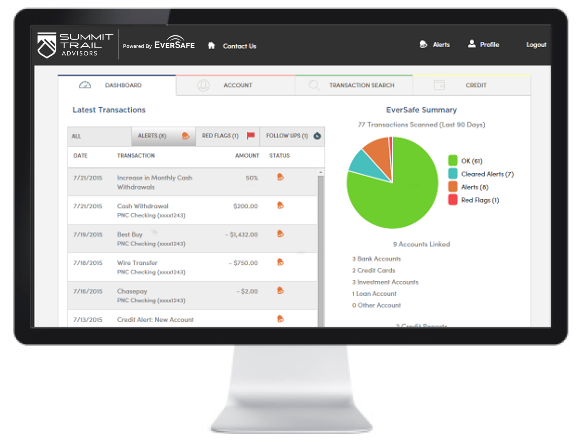

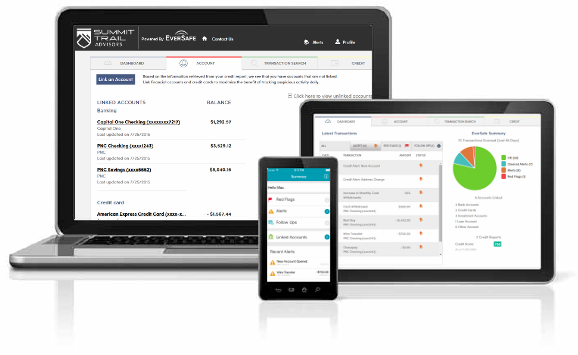

EverSafe connects to thousands of bank accounts, credit cards, investment accounts and your credit report.

EverSafe's monitoring goes well beyond identity theft protection.

EverSafe supports the designation of family members, professionals and/or other trusted advocates to assist in monitoring alerts.

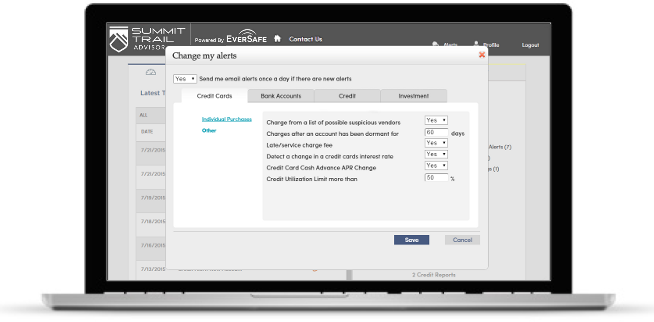

We'll email, text or call you with alerts — you choose the manner of communication.

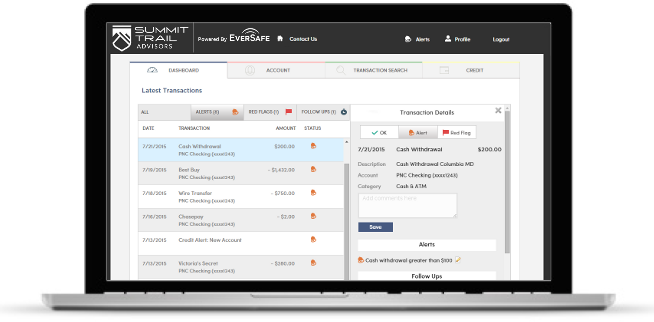

When suspicious activity is marked with a red flag, the resolution process begins. You can easily maintain notes, set follow-up dates and even request EverSafe's support to help you create your recovery plan. If you ever need help, we're only a phone call away.

EverSafe provides you with the convenience of consolidated reporting. You can see individual transactions, balances and alerts on all of your accounts, across institutions — all in one place.